The year 2021 is half way through. It is still a tough year for everyone, even for all people in the world. However, the condition of the Covid-19 pandemic does not mean sitting idle and lamenting the situation. Economic activity must continue, the world still needs nutritious food. At least that is the spirit of shrimp farmers in Indonesia.

Towards the second year of the pandemic, this important sector that contributes to the country's foreign exchange continues to stretch and even record achievements. Shrimp is still the aquaculture sector that is relied on to drive the economy from the lowest level to contribute to state income. Check out the brief analysis of the following Kabar Udang about halfway through 2021 Indonesian shrimp cultivation.

Two peaks in shrimp prices, June is over, get ready for September-October

Shrimp prices in a number of areas, especially most areas on Java, are monitored to be relatively stable with an increase or decrease that is not really significant. Price increases have continued since the beginning of the year in sizes 100, 70, and 30 until the middle of this year. There was a decrease, which was recorded in mid-February and May. Ending June to mid-July is the highest price record for all of 2021.

Reflecting on what happened last year, June is one of the peaks of shrimp prices. Entering the second semester, prices would usually tend to fall and reach their peak again during September to October. This also happens in various parts of Indonesia (read the previous Shrimp News: Shrimp Price Trends 2020, How's 2021?). Prices in Java would be relatively higher than those in Sumatra and Nusa Tenggara.

So, prepare the best harvest achievement in terms of size, SR, and FCR in order to get the maximum profit margin when shrimp prices are at their peak.

Record! It was recorded during a pandemic

Who would have thought, Indonesia actually recorded an export volume record in the midst of the Covid-19 pandemic. The good news in the midst of disaster.

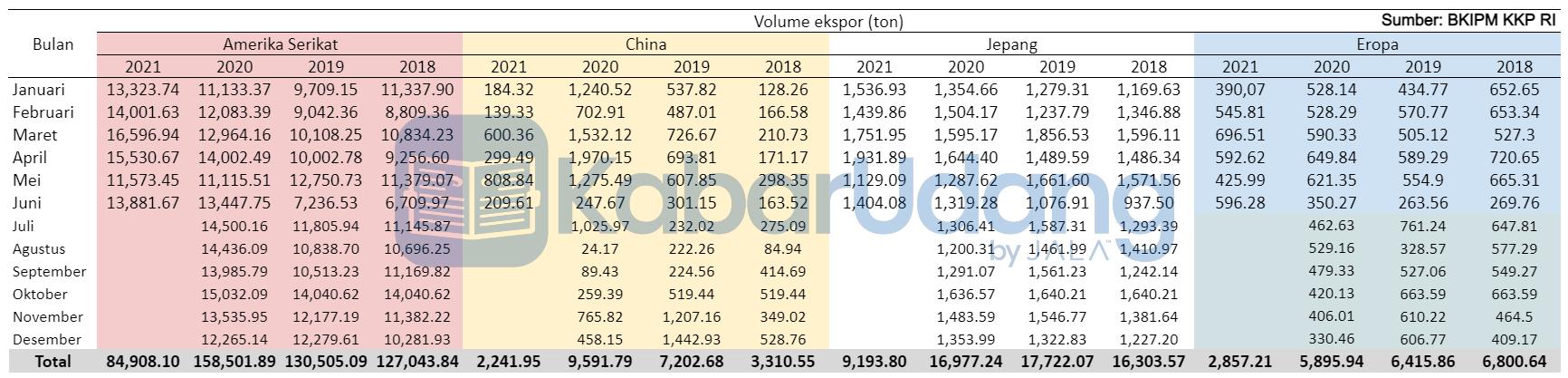

The United States (US) is still the main destination for Indonesian shrimp exports. A record was recorded in March, which was the highest volume of exports ever shipped to the US. In general, exports to the US tend to increase from year to year. This year, the sharp increase in exports to the US was obtained from increased demand of the retail segment, which came with the impact of India suppliers unable to meet the demand.

In early 2021, it was estimated that the increase in exports from Indonesia would also be driven by the inhibition of shrimp production from India, which was the main contributor to shrimp imports in the US. Indonesia was able to take advantage of the situation, but now India is slowly returning and the volume of exports from Indonesia is getting lower. The prediction is that the peak of exports to the US usually occurs in October.

Another destination, the second destination of Indonesian shrimp, is Japan. Export volume to Japan is relatively stable. Furthermore, in the Asian region, the export market to China is still very volatile. The impact of the pandemic seems to have not been completely overcome, so the seafood market in China is still unstable. Towards Europe, the volume of exports to a number of countries in Europe is still relatively low. However, in total, it shows a fairly well-maintained stability.

.jpg)

Cited from the Shrimp Insights, in 2020 Indonesia recorded the most impressive increase in exports compared to all shrimp producers in Asia. Data from BKIPM recorded a volume increase of 24%. In 2020, the increase in exports began in June and peaked in September. The record occurred in March when Indonesia's total shrimp exports reached 20.5 thousand tons. This is the best record for monthly export volumes so far. On a monthly basis, 2021 also recorded a good sign that 2021's export performance could surpass the previous years.

The EU import market is still dominated by South American shrimp producers. For countries in Asia, there was a decrease in the export trend to the European Union which occurred from 2015 to 2020, including Indonesia. The shrimp import market in the European Union could not be underestimated. Every year 230 thousand tons of shrimp enter the European Union, while 67% are supplied by countries from South America. The demand for shrimp from European Union countries has always been recorded to increase. An opportunity not to be missed.

Production continues

The question remains, whether the increase in Indonesian shrimp exports is in line with the increase in production or there are other factors. So it is quite difficult to depict with certainty that the increase in exports is supported by an increase in production or there is a shift in the proportion of aquaculture production that is getting bigger for the export.

In fact, shrimp production in Indonesia has not suffered from the COVID-19 pandemic. Even at the beginning of the pandemic (March 2020) there was fear due to indications of falling market demand, impacting the falling shrimp prices at the level of farmers. In addition, there were rumors of an increase in feed prices. The unavailability of definitive data on the amount of Indonesian shrimp production left big questions.

The real obstacles actually come from the weather conditions and disease attacks. The weather in Indonesia was quite unstable and had an impact on the continuity of cultivation. While a fairly massive disease attack occurred in mid-2020, now farmers look like they have been able to control it.

According to William van der Pijl on his website (shrimpinsights.com) providing suggestions to Indonesia, in realizing the increase in production launched by the government, the Indonesia government and industry need to take three steps:

- Increasing certification for shrimp farms

- Prioritizing funds allocated for shrimp farming expansion by the central and local governments

- Adopting modern technology and supplying the good quality prawns

- Adopting the sustainable shrimp farming protocols as a prerequisite for certification

Quality seeds, intensive and super-intensive pond expansion, biosecurity, and sustainable aquaculture would support the increase in Indonesian shrimp production.

Covid-19? We Indonesian farmers refuse to give up!

Shrimp farming shows itself as one of the business sectors that continues to thrive even in the midst of the pandemic. Target of an increase in production and exports also offers a signal that would always be afforded hand in hand with the regulatory support for the pro-farmer, production technology improvement, increase of competitiveness, and also job expansion. Realizing a 250% increase would require more active cultivation land and more work. So, more and more workers would be needed. The improvement of cultivation technology is also needed, namely by intensifying cultivation technology.

Now the main challenge actually comes from the disease plague that attacks the shrimp. Comprehensive solutions are needed in order to prevent disease or minimize losses when the disease occurs. Strict monitoring, regular health checks, and provision of quality feed would be more meaningful.

In order to increase the exports, support from regulators, in this case the government, is also needed. Need to add export destinations. Currently, about 80% of Indonesian shrimp are exported to the US. It could be said that the conditions are not good from the marketing side because it could lead to dependence. It is necessary to expand the market to countries that have not been touched or make improvements in the European Union for example.

There needs to be an increase in competitiveness in terms of products and stakeholder encouragement. In terms of products, farmers in Indonesia need to pay attention to shrimp production in ways standardized and guaranteed free from the use of antibiotics. Then the government and the private sector need to encourage economic cooperation with the European Union, one of which is by offering Indonesian cultivation of shrimp products with guaranteed supply and quality products. This happens in Ecuador which increases cooperation with the European Union and gains an increase of export volume.

(Eng: Danan)

References and further reading material

Willem van der Pijl. 2021. Does Asian Shrimp Have Future EU Market? Shrimp Insights.

Willem van der Pijl. 2020. Indonesia's 2020 Production Most Likely Stable Best Export Significantly . Shrimp Insights.